Multi-Currency Wallet at Your Fingertips

Streamline transactions across various services in a singular, user-friendly platform.

-

Remit Funds and Accept Payments Globally via Local Currency And Payment Rails

-

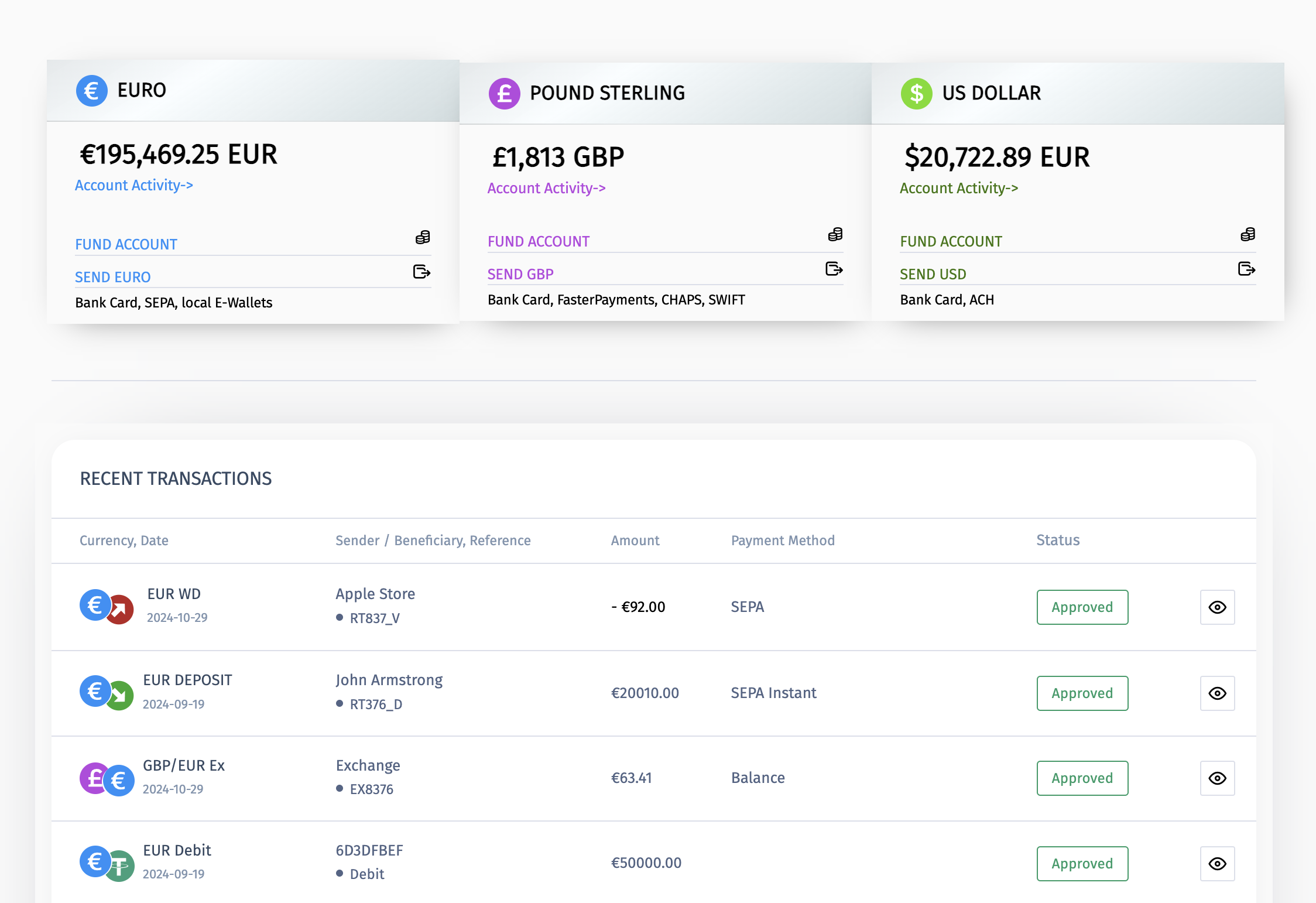

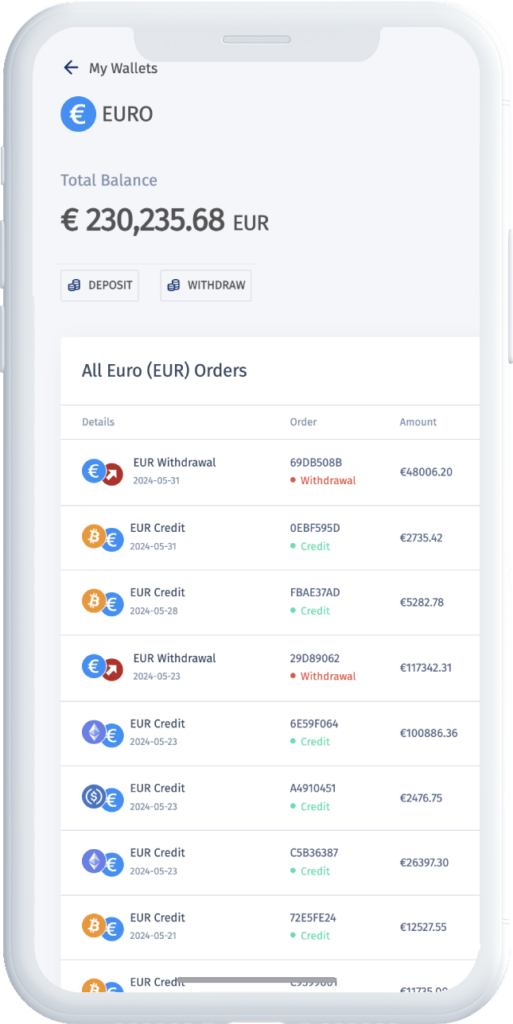

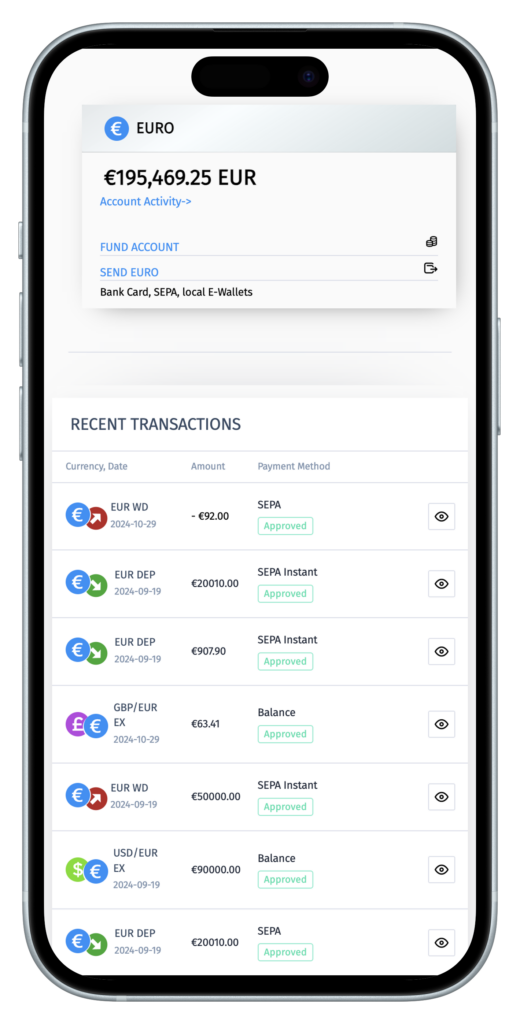

Accounts in EUR, GBP, USD and CAD

-

Save on Fx Rates and Transact in Local Currency

-

Secure encryption protocols

-

20 Cryptocurrency coins and wallets available

QUICK AND EASY ACCOUNT VERIFICATION

Verification Done in Minutes. Not Days.

Upnexus takes its AML obligations very seriously. Therefore, we employ multiple and automatic onboarding systems to allow for a thorough yet swift KYC and AML screening.

Have your ID, Utility Bill and mobile phone ready to have your account verified within minutes.

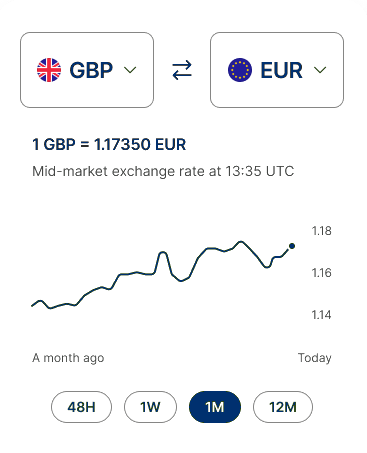

MULTI-CURRENCY PAIRS

Exchange +30

Fiat and Crypto Currency Pairs

-

Immediate fulfillment OTC Crypto Exchange

-

Best Price Order Execution Known In Advance

-

Multiple Funding and Purchase Methods Including Visa, Mastercard, SEPA, SEPA Instant,FasterPayments, CHAPS, Interac and Many More Local EU E-Wallets

-

Expand Your Clientele and Transact in Local Currency

B2B Technology Exchange Services

UPNEXUS' 360 B2B solutions include an array of technological solutions for exchanges and liquidity providers.

Full API *

Effortlessly manage multiple wallets held with BitGo or other custodians/self managed wallets. Control deposit withdrawal and exchange activities via an API interface using your own financial accounts!

*For qualified financial institutions meeting specific regulatory authorization.

*UPNEXUS will only onboard financial institutions as a technology client and NOT as a client of its remittance or exchange activities.

Tailor made CRM

UPNEXUS will customize your CRM and exchange platform based on your business methodologies and needs.

Our CRM is integrated with a variety of financial providers - banks, EMIs, E-Wallets and credit card processors

Multiple Existing Integrations

UPNEXUS is integrated with a large variety of finance and technology providers.

This includes credit card processors, banks and EMI/PI, E-Wallets, Payment initiation services such as Open Banking, Klarna, ACH.

Upnexus is also integrated with the top tech providers in the world of Crypto such as Refinitive WorldCheck, SumSub, Idenfy, Crystal BitFury, PayNetEasy, PaxisPay.

Reach Global Clientele with a Local Touch. Explore UPNEXUS' Payment Methods

UPNEXUS is fully integrated with numerous payment methods to help your global reach and expansion of your clientele.

Payment Methods include Faster Payments and CHAPS (Local GBP), SEPA, SEPA Instant (EUR), Interac (Local $CAD), Local CHF transfers within Switzerland, Global SWIFT transfers in USD, EUR, GBP and many more.

UPNEXUS will onboard clients from all jurisdictions except the countries listed in the "Customer Acceptance Policy and Prohibited Juristictions" below.

A complete list of UPNEXUS acceptance policy can be found here:

UPNEXUS will onboard clients deemed as medium risk level or lower in accordance with our risk policy. High risk industries such as Gaming, Adult, Controlled substances including tobacco and cannabis will be rejected for onboarding.

For individual onboarding initial account verification you would need:

- Identification document - Passport, ID or Drivers license in most jurisdictions.

- Proof of Address: Utility bill such as electricity or cable bill or bank statement issued in the last 3 months.

- Mobile Phone with a camera to upload images of your ID and Proof of Address.